The United States government has invoked a statutory debt-default clause to block Ghana from accessing foreign assistance, including development loans and flagship programmes such as the Millennium Challenge Corporation (MCC), beginning in the 2026 fiscal year.

According to an Economic Intelligence Report, the decision stems from Section 7012 of the FY 2025 State, Foreign Operations and Related Programs Appropriations Act, which prohibits US aid to countries that have defaulted on debt owed to US entities without concluding a restructuring agreement.

Both the MCC and US State Department confirmed compliance with the restriction on 6 August 2025.

Why Ghana was penalised

Two defaults appear to have triggered Washington’s action:

- Ghana’s December 19, 2022 debt standstill, which suspended payments on Eurobonds, commercial loans, and most bilateral debt — instruments held by major US financial institutions.

- Unpaid arrears totalling US$251 million owed to American companies, including Twin City Energy, American Tower Company, Chubb, GSM, Kosmos Energy, and Zipline.

Some of these payments are backed by the US International Development Finance Corporation (DFC), raising US taxpayer exposure concerns.

Political pressure in Washington

US Senate Foreign Relations Committee Chairman James Risch (R-Idaho) has repeatedly criticised Ghana’s arrears profile, accusing Accra of honouring Chinese creditors while defaulting to US firms. He has also pressed the US government to use its IMF leverage to halt additional funding to Ghana.

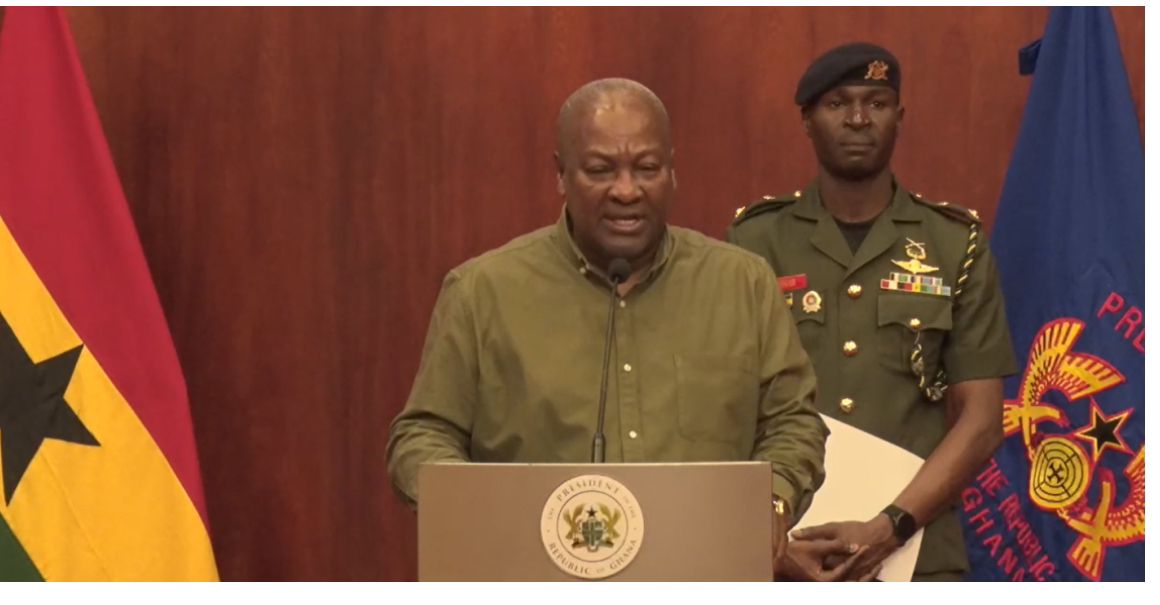

Ghana’s position

Accra classifies the disputed payments as part of a US$2.6 billion “legacy energy sector debt”, seen by US officials as the failure of state agencies — particularly the Electricity Company of Ghana (ECG) — to meet obligations, rather than private-sector risk.